Are you bombarded with messages about Medicare? Once you turn 65, you are probably thinking about how you can enroll in Medicare and which plan is right for you. Whether you are already enrolled in Medicare or just beginning the process of enrolling, learning about the basics will help you to navigate the process and make enrolling in a plan much easier.

Disclaimer: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.

Medicare Basics:

There are 4 Parts to Medicare: Part A, Part B, Part C and Part D

Part A: covers hospitalization

Part B: medical insurance

Part C: also called Medicare Advantage plans, “all in one” plans that cover medical, hospitalization, and drug coverage (Part D)

Part D: prescription drug coverage. Required to have, even if you do not take prescriptions

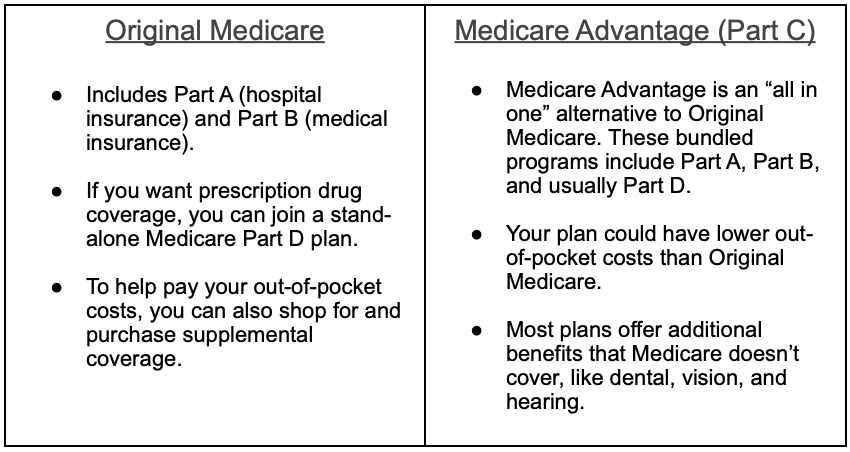

When you first sign up for Medicare and during certain times of the year, you can decide how to get your coverage. There are two main ways to get Medicare:

Medicare Advantage Plans:

If you decide to purchase a Medicare Advantage (Part C) plan, you are required to have Original Medicare ( Part A and B). This all-in-one plan allows you to have prescription coverage, as well as dental and vision coverage.

With a $0 monthly premium, they are an attractive option. However, they have a medical deductible and copays, so you are essentially paying for your care “as you go.”

Additionally, since the drug coverage is built in, there is a separate deductible for prescriptions.

Another option: Medicare Supplement (Medigap) plans

Surprise expenses are no fun. You can also enroll in a Medicare Supplement (Medigap) plan to help fill the gaps in your Original Medicare coverage, so there are more predictable out-of-pocket costs. The most popular plans nationwide are G and N.

With these plans, there is a monthly premium, so you are essentially paying for your medical care “up front.” However, these plans offer the most comprehensive coverage, and typically only require you to pay a small copay or percentage of medical costs and the Part B deductible. However, Medigap plans do not include drug coverage, so you must purchase a separate Part D plan to fulfill the requirements.

Which is right for you?

Considering the difference between Medicare Advantage and Medigap plans is essential to decide which is right for you. A Medicare-certified broker has access to all options available to you and can help you decipher which option is best for you.

Below is a chart highlighting the different options:

| Medicare Advantage | Medicare Supplement |

| 1. “All in one” option 2. Offered through private insurance companies 3. Includes drug coverage 4. Includes dental/ vision coverage$0 premium 5. Medical deductibleCopays for services 6. A specific network of doctors and hospitals 7. May need a referral depending on the plan 8. Does not hold pre-existing conditions against you 9. Availability limited to your service area (zip code) 10. Good option if you have low healthcare utilization | 1. Covers gaps in Original Medicare 2. Offered through private insurance companies 3. No drug coverage 4. Does not cover dental/ vision 5. Has monthly premium 6. Only have to pay the Part B deductible 7. May have copays or % of services depending on plan 8. A nationwide network of doctors and hospitals 9. No referrals required 10. May rate you based on your health 11. Availability is limited to that of the carrier 12. Good option if you have high healthcare utilization or have high medical costs 13. Good for travel |

How to choose a Part D plan

In addition to Original Medicare, you are required to enroll in Part D coverage or you could face a penalty for not enrolling in time.

Choosing a Prescription Drug Plan (PDP) depends on various factors including:

- How many prescriptions you take

- The type of prescriptions (generic vs. brand name)

- Insurance company formulary (list) of covered drugs

- Pharmacy networks

In order to choose a PDP that works best for you, it is important to work with a Medicare-certified broker because they have access to all available information to help you make the right choice. Also, having all the information about your prescriptions at the time of enrollment is important because you can make sure you won’t have any surprises at the pharmacy

Overall tips to choose the right plan

Choosing a Medicare plan can be confusing because there are so many different options from different carriers so it can be difficult to decide which is best for you.

Here are some tips to make sure you choose the right plan and have the best coverage for your healthcare needs.

Get professional help

Going through the Medicare process alone can be a daunting task. Instead, working with a Medicare-certified broker can help you make the right choice. Their services are 100% free and they are able to help you make sense of all of the different options.

Determine your budget

One of the common misconceptions about Medicare is that it is 100% free. However, this is not the case. With the different parts of Medicare, come extra costs that you may have not considered. It is important to determine your monthly budget for healthcare and decide what you can afford before making a decision.

Assess healthcare costs

If you frequent the doctor, take prescription medications, or have an upcoming procedure, thinking about your healthcare costs is important when you make your plan selection.

Think about healthcare utilization

Think about how often you go to the doctor or if you need to see a specialist often. If this is the case, it may be worth opting for a plan that has richer benefits so your out-of-pocket expenses aren’t so high.

Think about which doctors are important to you

Finally, considering which doctors are important to you will be a good starting point to know which plan is right for you. Making sure your doctor takes your plan and is in network with the plan will make sure you do not have a surprise out-of-network bill.

All in all, Medicare has a lot of parts and can take some time to understand. Working with a Medicare-certified broker can help take care of your needs and take the confusion out of the process.

Contact me today for a free consultation.