Life Insurance

Find the Life Insurance That Fits Your Needs and Budget

If someone you love depends on you for everything, you need a life insurance policy. It’s your responsibility to protect the people in your life. What would happen if you’re gone and unable to care for your loved ones?

So, if you know you need to protect your family but aren’t sure how to choose the plan that’s best for you, you’ve come to the right place. When shopping for life insurance, it’s important to speak to a broker or specialist who understands the different products and how you can use them to influence your financial goals.

What Is Life Insurance and How Does it Work?

Life insurance is a contract between you and an insurance carrier to provide you with coverage — based on your payment of premiums. It provides a death benefit to your chosen beneficiary (typically a spouse) upon your death.

When you pass away, your beneficiary will file a claim with the carrier to submit a death certificate (proof of your passing). If there’s an agent who works with your family, your beneficiary can contact the agent who will help him or her fill out the required paperwork. Or, your beneficiary can reach out to the carrier directly, and a claims representative will provide further instructions.

After the insurance carrier gets all the documents, your beneficiary will be issued the death benefit payout.

Main Types of Life Insurance

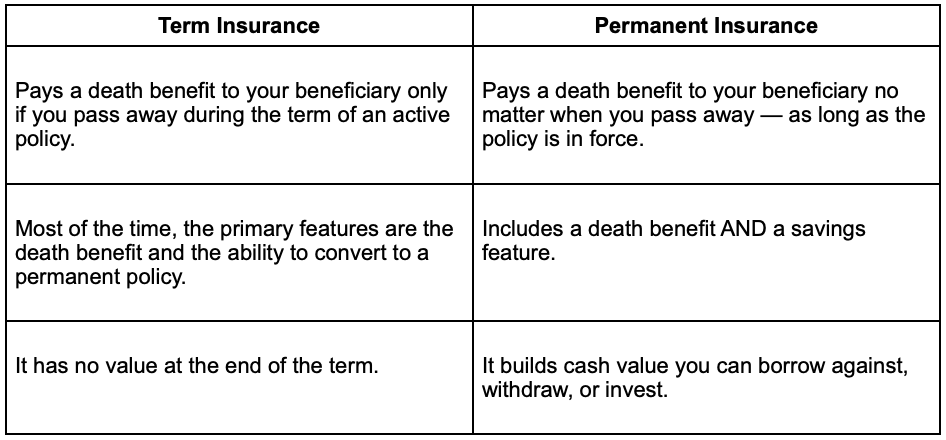

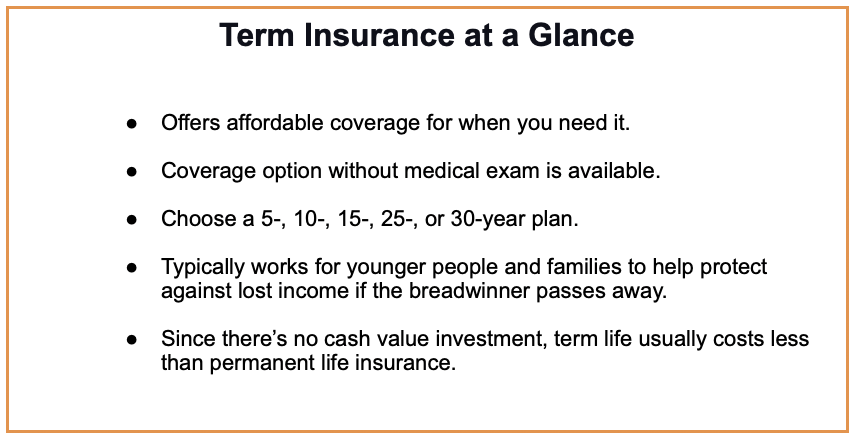

Life insurance can be temporary or permanent. Temporary insurance is commonly called term insurance, and policies are issued for a certain number of years, often from 5 to 30. Term life could help pay off a mortgage or fund a college education.

Permanent insurance covers you for your entire life. Let’s look at the two types side-by-side:

Which Type Is Right for You?

Everyone’s situation is different. Term life could help pay off a mortgage or fund a college education.

However, if you want to access a guaranteed cash value account, you should choose a whole life policy. You’ll also get guaranteed level premiums and protection for as long as you live.

How Policies Are Issued

Life insurance policies are either simplified issue or fully underwritten. Simplified issue policies only require you to answer some health questions on the application. They may cost more because the insurance company doesn’t have as much proof about your health.

Fully underwritten policies require you to take a medical exam and complete lab work. Typically, you get a lower premium with these if your results indicate that you’re in good health.

What Determines Your Premium Rate?

In general, the younger and healthier you are, the less you’ll pay for life insurance. The most important factor in calculating your rate is usually age. Other variables include:

- Gender: females often get lower rates because they tend to live longer.

- Family medical history

- Results from medical exam

- Lifestyle: smoker/nonsmoker, alcohol use, risky hobbies, etc.

- Location

- Marital status

How Much Should You Buy?

It depends on your stage in life. It’s usually good to get 10-12 times your annual income in term life insurance. For many families, a 20-year term is a perfect fit. Remember, speak with an agent to discuss more details about your needs.

Contact Katherine Phillips Insurance

Every type of life insurance plan has its pros and cons. I can help you determine which policy type is best for your family’s needs and budget. And I can help ensure the lowest premiums! Don’t put it off any longer — contact me to lock in your rates now.